Power Law (Pareto) Distribution

Maths: Statistics for machine learning

2 min read

Published Oct 22 2025, updated Oct 23 2025

Guide Sections

Guide Comments

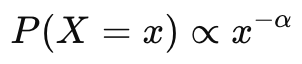

A Power Law Distribution describes a situation where small occurrences are extremely common,

but large occurrences are very rare, following the general rule:

In simple terms:

“A few items account for most of the effect.”

Examples: a few rich people own most wealth, a few websites get most traffic, a few words dominate language use.

It is also known as the Pareto Distribution (after economist Vilfredo Pareto).

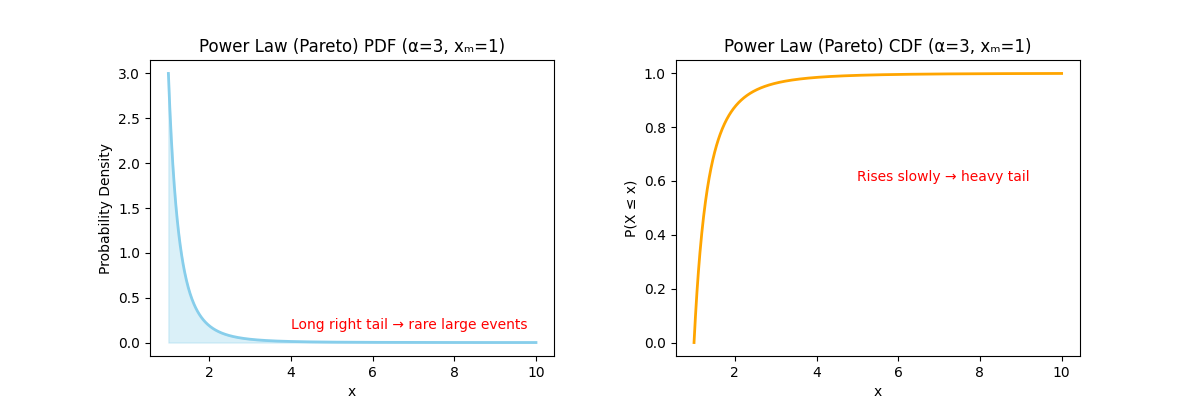

Probability Density Function (PDF)

Where:

- xm = minimum possible value (scale parameter)

- α = shape parameter (also called the power law exponent)

The PDF decreases rapidly as x increases — forming a long right tail.

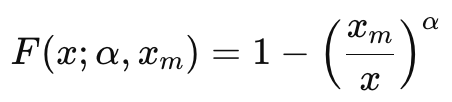

Cumulative Distribution Function (CDF)

As x → ∞, F(x)→1

Intuition

- Small values are very common (high probability near xm)

- Large values are rare, but not impossible — producing a long tail

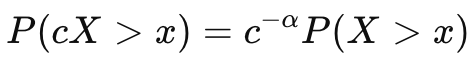

- The distribution is scale-invariant, meaning the shape looks the same at any scale:

Examples

- Wealth distribution - A few individuals hold most wealth

- Internet traffic - Few sites get most visits

- City populations - Few cities are very large

- Word frequencies - Few words used very often

- Social networks - Few users have many followers

- PDF (left): High probability near the minimum (xₘ), with a long, slow-decaying right tail.

- CDF (right): Increases quickly at first, then slowly approaches 1.

The Power Law shows that extreme events are rare but not negligible.

The tail never fully disappears — there’s always some chance of very large values.

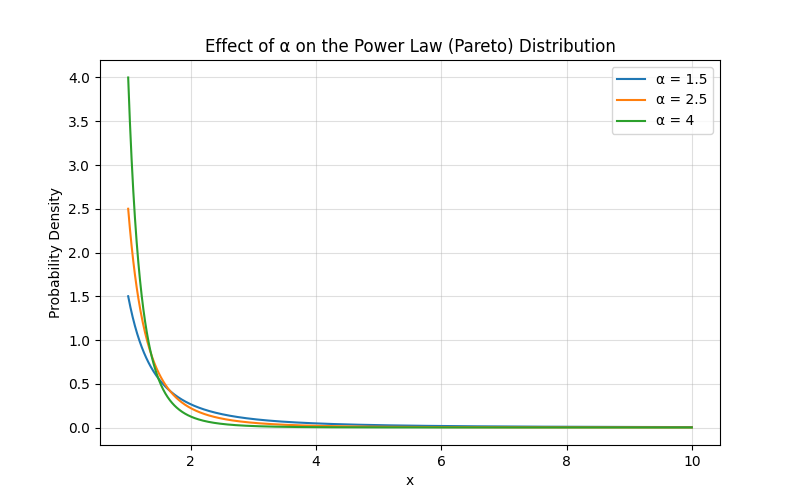

Effect of α (Shape Parameter)

Smaller α → heavier tail (more big events)

Larger α → lighter tail (big events become rarer)

In Machine Learning and Data Science

- Modelling heavy-tailed data - Wealth, web traffic, popularity, network degrees

- Anomaly detection - Detecting rare extreme outliers

- Natural language processing - Word frequencies (Zipf’s law)

- Network science - Power-law degree distributions in social graphs

- Economics / risk modelling - Financial returns, market volatility (tail risk)

- Generative modelling - Sampling realistic “long-tail” distributions